Economical Anal ysis of Tax Law: Free Initiative , Free Competition , Fiscal Neutrality

DOI:

https://doi.org/10.5433/2178-8189.2010v14n0p235Keywords:

Economical Analysis of Law, Taxation, Competition, Fiscal Neutrality.Abstract

This essay is focused on the economical analysis of tax law. It aims to bring the tax justice close to the economic justice, in a relation of complementation. This movement comprehends many schools which require the normative perspective that identify, inside the Law, economical elements as source of validity and efficacy of the rule of Law. In order to perform that movement, it is necessary two principles important to Law (Article 170, CF/88) and to Economy: Free Initiative and Free Competition, both juridical and economical reference which may be considered when the State intervene into the economical sphere, using taxation according to Article 146-A, from the Constitution of 1988. Efficacy, free initiative and free competition are possible when the principle of fiscal neutrality is observed. Which enables: i) equality of conditions inside the markets; ii) lack of State barriers of entering and staying inside a market; and, iii) void or minimal intervention of the State in the market game.

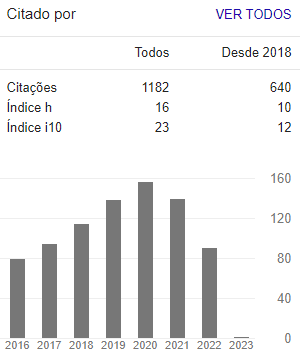

Downloads

Downloads

Published

How to Cite

Issue

Section

License

Copyright (c) 2022 Scientia Iuris

This work is licensed under a Creative Commons Attribution 4.0 International License.

The journal reserves the right to modify, in the original text of the submitted article, normative, spelling and grammatical mistakes in order to maintain the cultured standard of language and the credibility of the journal. The journal will respect the authors' writing style. Changes, corrections or suggestions of conceptual order will be sent to the authors, when necessary. In such cases, the articles will be re-examined. The final exams will not be sent to the authors. The published works become the property of the journal, in other words, its total or partial reprinting is subject to the express authorization of the journal. In all subsequent citations, the original source of publication shall be cited and in the case of Photographic Speeches, shall be approved by the original author. The opinions expressed by the authors of the journal's articles are of their sole responsibility.