The constitutional limits to the tributary planning

DOI:

https://doi.org/10.5433/2178-8189.2005v9n0p253Keywords:

Tax planning, constitutional limits, principlesAbstract

Tax planning is a self-organization’s right of tax payers, due to that, they can organize its activities in the limits of legality, in order to reduce, to postpone or even to prevent rate of tributes. However, this right to self-organization is not, and cannot be, absolute. It has to find its limits in the respect to constitutional principles like: the fact’s precision with the hypothesis of the law, and strict legality.

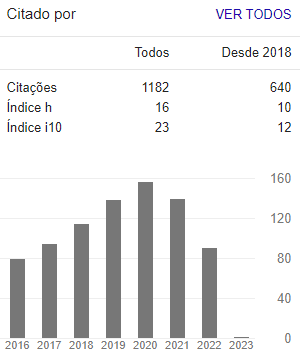

Downloads

Download data is not yet available.

Downloads

Published

2005-12-15

How to Cite

Sakamoto, P. Y., & Bassoli, M. K. (2005). The constitutional limits to the tributary planning. Scientia Iuris, 9, 253–272. https://doi.org/10.5433/2178-8189.2005v9n0p253

Issue

Section

Artigos