Economic aspects of the right human tax benefits for disabled people

DOI:

https://doi.org/10.5433/2178-8189.2008v12n0p199Keywords:

Basic rights, tax benefits, disabled peopleAbstract

This article approaches basic rights and their efficiency in the specific case of disabled people entitled to special conditions when buying a vehicle, but who are not able to drive. It points out the coherence of a systematic integrative and legal interpretation of CTN article 111 of the Federal Constitution and ordinary laws, as well as the coherence of the Courts when solving such issues. The in loco research shows that companies do not accept to exempt customers from taxes when it is not the disabled person him/herself who will drive the car. On the other hand, when a systematic analysis was conducted, we could identify decisions that favor such rights even when the disabled person is not able to drive. Finally, the straight parallel of the basic rights indicates the change of responsibility for the acquisition process to the supplier and the State action, enabling and even rewarding resolutions like those as a solution to the analyzed problem.

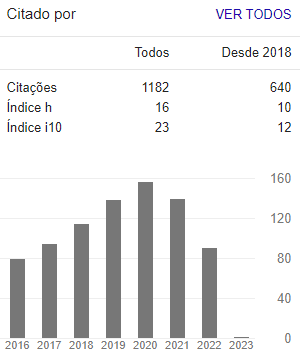

Downloads

Downloads

Published

How to Cite

Issue

Section

License

Copyright (c) 2022 Scientia Iuris

This work is licensed under a Creative Commons Attribution 4.0 International License.

The journal reserves the right to modify, in the original text of the submitted article, normative, spelling and grammatical mistakes in order to maintain the cultured standard of language and the credibility of the journal. The journal will respect the authors' writing style. Changes, corrections or suggestions of conceptual order will be sent to the authors, when necessary. In such cases, the articles will be re-examined. The final exams will not be sent to the authors. The published works become the property of the journal, in other words, its total or partial reprinting is subject to the express authorization of the journal. In all subsequent citations, the original source of publication shall be cited and in the case of Photographic Speeches, shall be approved by the original author. The opinions expressed by the authors of the journal's articles are of their sole responsibility.