Considerações sobre a prevalência dos tratados internacionais sobre a legislação tributária brasileira: o caso do MERCOSUL

DOI:

https://doi.org/10.5433/2178-8189.1997v1n0p99Keywords:

International treaties, Prevalence, Mercosur, Domestic tax legislation.Abstract

This is a study on the main aspects discussed in the Brazilian doctrine and the jurisprudence concerning the prevalence of international treaties and conventions for internal tax legislation. Considerations are made on the Brazilian federate and sovereignty principles and on the competence constitutionally established for all the political entities of the Brazilian State. Article 151, section III of the Federal Constitution must be pointed out for its purpose on stating that the Union shall not exempt the States, the Federal District and the Municipalities from respective taxes. Article 98 of the National Tax Code is also considered for its disposition concerning legislation from international treaties and agreements on tax norms of the positive system currently in force.

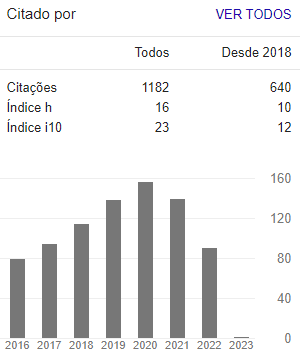

Downloads

Downloads

Published

How to Cite

Issue

Section

License

Copyright (c) 2022 Scientia Iuris

This work is licensed under a Creative Commons Attribution 4.0 International License.

The journal reserves the right to modify, in the original text of the submitted article, normative, spelling and grammatical mistakes in order to maintain the cultured standard of language and the credibility of the journal. The journal will respect the authors' writing style. Changes, corrections or suggestions of conceptual order will be sent to the authors, when necessary. In such cases, the articles will be re-examined. The final exams will not be sent to the authors. The published works become the property of the journal, in other words, its total or partial reprinting is subject to the express authorization of the journal. In all subsequent citations, the original source of publication shall be cited and in the case of Photographic Speeches, shall be approved by the original author. The opinions expressed by the authors of the journal's articles are of their sole responsibility.